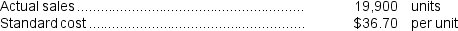

Ciresi Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The company has provided the following information: The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

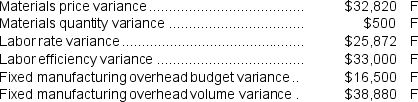

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year: The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

Definitions:

Investee's Net Income

The total profit of a company in which another company has an investment interest, after all expenses and taxes have been subtracted.

Original Cost

The initial amount of money spent to acquire an asset, including purchase price and all expenses incurred to bring it to its intended use.

Unrealized Gain

A profit that exists on paper as a result of an investment increasing in value but has not yet been sold for cash.

Available-for-Sale Investments

Securities that are not classified as held-to-maturity or trading securities and can be sold in the short-term or kept for long-term holdings, with unrealized gains or losses reported in other comprehensive income.

Q8: The standard cost of direct material for

Q19: Division R of Harris Corporation has the

Q23: Mangiamele Corporation's Maintenance Department provides services to

Q66: The turnover for this year's investment opportunity

Q102: The net operating income for the year

Q121: What was the West Division's residual income

Q125: When the direct labor cost is recorded

Q218: The materials quantity variance for January is:<br>A)

Q224: The materials quantity variance for August is:<br>A)

Q313: The net operating income in the planning