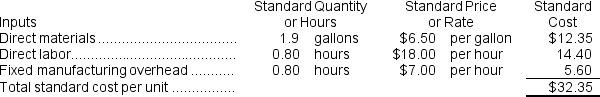

Ester Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

During the year, the company applied fixed overhead to the 22,600 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $149,800. Of this total, $83,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $66,000 related to depreciation of manufacturing equipment.

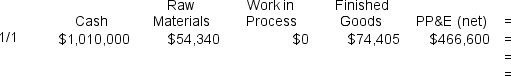

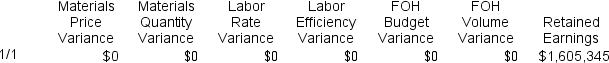

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

Definitions:

Intellectual Characteristic

A trait or feature relating to the intellect, such as analytical thinking, creativity, or knowledgeability.

Experience of Flow

A state of deep focus and immersion in activities, where individuals lose sense of time and self-awareness.

Rapid Succession

Occurring in a quick and consecutive manner, often with minimal intervals in between.

Q54: What was the Consumer Products Division's residual

Q55: For the past year,the minimum required rate

Q92: The direct materials in the flexible budget

Q109: Bonavita Corporation is a service company that

Q122: The ending balance in the Retained Earnings

Q172: The variable overhead efficiency variance for April

Q240: Pleiss Corporation applies manufacturing overhead to products

Q332: The occupancy expenses in the flexible budget

Q333: The spending variance for food and supplies

Q378: Magliacane Corporation is a service company that