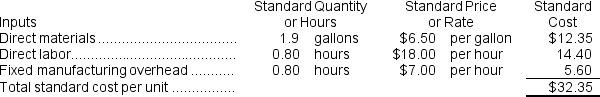

Ester Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

During the year, the company applied fixed overhead to the 22,600 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $149,800. Of this total, $83,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $66,000 related to depreciation of manufacturing equipment.

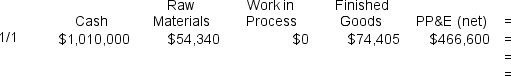

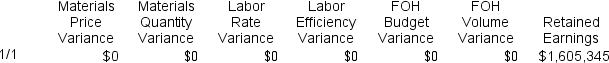

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

Definitions:

Supportive Leadership

A leadership style characterized by a focus on building relationships, encouraging open communication, and supporting employees in their personal and professional development.

Leadership Style

The characteristic manner and approach of providing direction, implementing plans, and motivating people that is utilized by a leader.

Democratic Leadership

A leadership style where the leader makes decisions based on the input of each team member. It values collaboration and the free flow of ideas.

Concern For People

The degree of emphasis an organization or leader places on attending to the well-being and personal needs of their employees.

Q34: The selling division in a transfer pricing

Q81: Rohrer Products,Inc.,has a Motor Division that manufactures

Q106: What is ChocO's labor rate variance?<br>A) $902

Q145: Hoag Corporation applies manufacturing overhead to products

Q150: The following labor standards have been established

Q172: The variable overhead efficiency variance for April

Q184: The labor efficiency variance for the month

Q190: Variable manufacturing overhead is applied to products

Q220: The raw materials price variance for the

Q300: Bluemel Air uses two measures of activity,flights