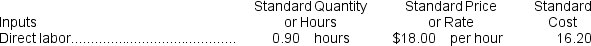

Decena Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. Information concerning the direct labor standards for the company's only product is as follows:

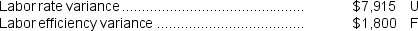

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

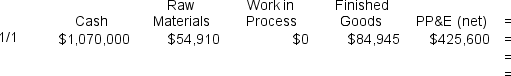

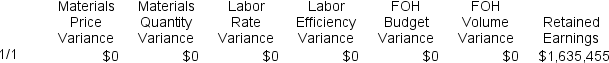

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the direct labor cost is recorded,which of the following entries will be made?

Definitions:

Capital Loss

The result of selling an investment or asset for less than its original purchase price.

Tax Expense

The total amount of tax an individual or corporation owes to the government, displayed on financial statements.

Appreciated Property

An asset that has increased in value over time from its original purchase price.

Nonliquidating Distribution

A nonliquidating distribution refers to distributions made by a corporation to its shareholders that are not in complete termination of the shareholder’s interest in the corporation.

Q24: The labor rate variance for the month

Q29: For performance evaluation purposes,how much of the

Q54: Assume that the Relay Division is selling

Q55: The medical supplies in the flexible budget

Q93: Assume that the Valve Division is selling

Q108: When recording the raw materials used in

Q214: The labor efficiency variance is:<br>A) $4,000 F<br>B)

Q273: The facility expenses in the flexible budget

Q398: The amount shown for revenue in the

Q407: Cosden Corporation is an oil well service