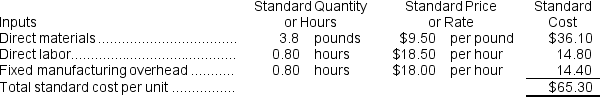

Robins Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

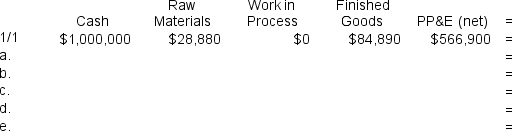

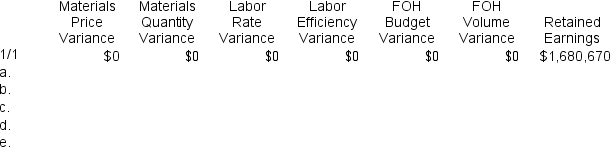

During the year, the company completed the following transactions:

a. Purchased 134,700 pounds of raw material at a price of $9.10 per pound.

b. Used 122,080 pounds of the raw material to produce 32,100 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 26,680 hours at an average cost of $17.20 per hour.

d. Applied fixed overhead to the 32,100 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $378,400. Of this total, $297,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $81,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 32,100 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When recording the direct labor costs in transaction (c) above,the Work in Process inventory account will increase (decrease) by:

Definitions:

Marginal Revenue

The increase in income resulting from the sale of an extra unit of a good or service.

Average Revenue Curve

A graphical representation showing how the average revenue per unit sold varies with the quantity sold.

Perfect Competition

A market structure characterized by many firms offering identical products, free entry and exit of firms, and full information availability, leading to efficient outcomes.

Total Revenue

The total income generated by a company or entity from its business activities, often calculated as the product of price and quantity sold of goods or services.

Q11: The activity variance for direct labor in

Q23: Mangiamele Corporation's Maintenance Department provides services to

Q84: When Raw Materials,Work in Process,and Finished Goods

Q95: Creaser Products,Inc.,has a Sensor Division that manufactures

Q125: The raw materials price variance for the

Q163: Sherburne Snow Removal's cost formula for its

Q168: The variable overhead rate variance for January

Q201: The revenue in the company's flexible budget

Q209: The net operating income in the flexible

Q314: The activity variance for wages and salaries