Arena Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.

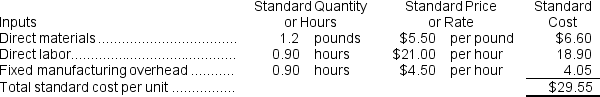

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $81,000 and budgeted activity of 18,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $81,000 and budgeted activity of 18,000 hours.

During the year, the company completed the following transactions:

a. Purchased 35,400 pounds of raw material at a price of $4.60 per pound.

b. Used 32,180 pounds of the raw material to produce 26,900 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 23,810 hours at an average cost of $20.60 per hour.

d. Applied fixed overhead to the 26,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $67,800. Of this total, $3,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $64,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 26,900 units from work in process to finished goods.

f. Sold (for cash) 27,100 units to customers at a price of $36.60 per unit.

g. Transferred the standard cost associated with the 27,100 units sold from finished goods to cost of goods sold.

h. Paid $149,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

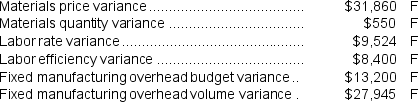

The company calculated the following variances for the year:

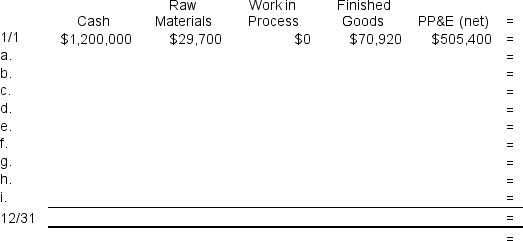

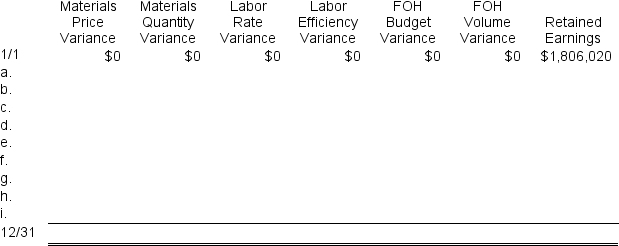

To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-The ending balance in the Finished Goods account will be closest to:

Definitions:

AGI

Adjusted Gross Income, which is total income adjusted by certain allowable deductions, serving as the base for calculating taxable income.

Qualifying Expenses

Expenses that are determined to be necessary and deductible under tax law for various benefits like education savings accounts or business expenses.

Child and Dependent

Terms used in tax law to refer to individuals for whom the taxpayer provides more than half of financial support, qualifying the taxpayer for certain deductions.

Care Expense Credit

A tax credit available for expenses incurred in caring for a qualifying individual to allow the taxpayer to work or look for work.

Q37: Using the formula in the text,if the

Q40: When recording the raw materials purchases in

Q46: Pyrdum Corporation produces metal telephone poles.In the

Q116: Tos Corporation's flexible budget cost formula for

Q123: Sulema,Inc.repairs and refinishes antique furniture.Manufacturing overhead at

Q126: Stallbaumer Incorporated makes a single product--an electrical

Q161: Stopher Incorporated makes a single product--a cooling

Q172: The labor efficiency variance is labeled favorable

Q202: Camps Inc.has a standard cost system.The standards

Q243: If skilled workers with high hourly rates