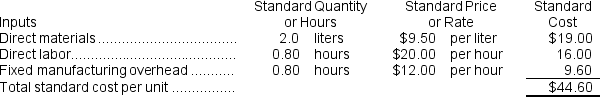

Alberts Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.

During the year, the company applied fixed overhead to the 15,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $223,700. Of this total, $147,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $76,000 related to depreciation of manufacturing equipment.

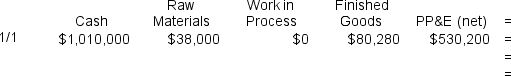

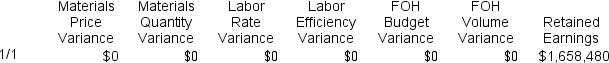

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

Definitions:

SVA

Stands for Shareholder Value Added, which is a measure used to evaluate a company's ability to generate wealth for its shareholders beyond the required rate of return on their investment.

PV of Cash Flows

The present value of expected future cash flows discounted at the relevant rate, reflecting the current worth of those cash flows.

Residual Value

The estimated value that an asset will have at the end of its useful life, after depreciation has been accounted for.

EVA

Economic Value Added, a measure of a company's financial performance based on residual wealth calculated by deducting cost of capital from its operating profit.

Q18: If demand is insufficient to keep everyone

Q19: Division R of Harris Corporation has the

Q24: Suppose that Division A is operating at

Q25: What is the maximum price that the

Q64: Mittan Products,Inc.,has a Antennae Division that manufactures

Q78: The fixed overhead budget variance is:<br>A) $14,000

Q115: The activity variance for cleaning equipment and

Q130: Loos Corporation uses a standard cost system

Q162: The raw materials price variance for the

Q347: Dunbar Footwear Corporation's flexible budget cost formula