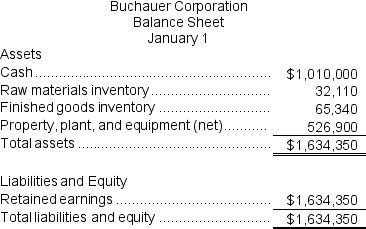

Buchauer Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The company's balance sheet at the beginning of the year was as follows:

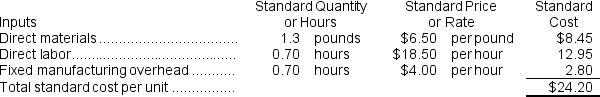

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

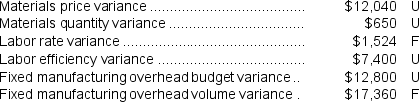

The company calculated the following variances for the year:

The company calculated the following variances for the year:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $42,000 and budgeted activity of 10,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $42,000 and budgeted activity of 10,500 hours.

During the year,the company completed the following transactions:

a.Purchased 30,100 pounds of raw material at a price of $6.90 per pound.

b.Used 27,660 pounds of the raw material to produce 21,200 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 15,240 hours at an average cost of $18.40 per hour.

d.Applied fixed overhead to the 21,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $54,800.Of this total,-$10,200 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $65,000 related to depreciation of manufacturing equipment.

e.Transferred 21,200 units from work in process to finished goods.

f.Sold for cash 22,800 units to customers at a price of $29.70 per unit.

g.Completed and transferred the standard cost associated with the 22,800 units sold from finished goods to cost of goods sold.

h.Paid $74,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

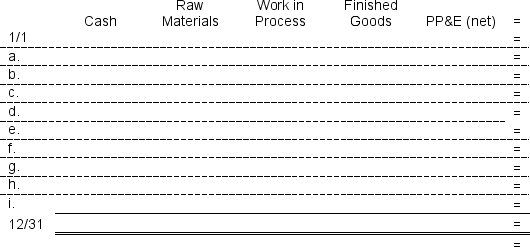

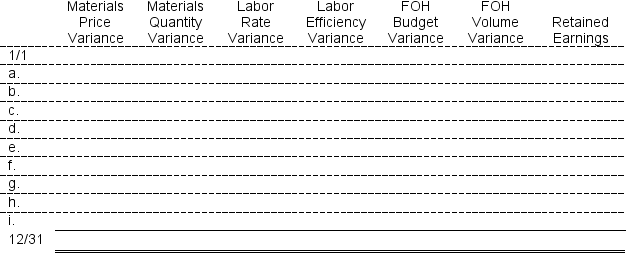

1.Enter the beginning balances and record the above transactions in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.

2.Determine the ending balance (e.g.,12/31 balance)in each account.

3.Prepare an income statement for the year.

Definitions:

Deviance

Actions or behaviors that violate societal norms, which can range from minor breaches of etiquette to serious violations of law.

Socioeconomic Classes

Categories of people based on their economic status, often determined by income, wealth, occupation, and education.

Victimized

Having been made the target of wrongdoing or harm, often unjustly.

Schoolchild

An individual, typically a minor, who attends an educational institution such as an elementary or secondary school.

Q20: If the denominator level of activity is

Q21: The variable overhead efficiency variance for June

Q37: Ciresi Corporation manufactures one product.It does not

Q60: Dalgleish Corporation manufactures one product.It does not

Q72: Shular Products,Inc.,has a Valve Division that manufactures

Q90: The materials quantity variance for June is:<br>A)

Q122: An activity variance is the difference between

Q196: The activity variance for "Employee salaries and

Q304: Aultz Tile Installation Corporation measures its activity

Q396: The "Employee salaries and wages" in the