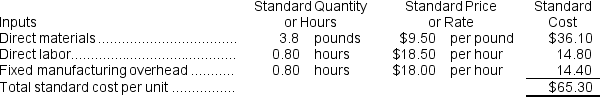

Robins Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

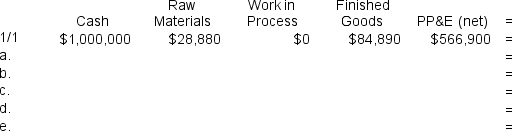

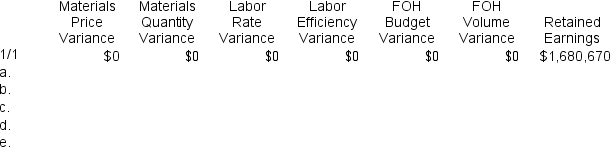

During the year, the company completed the following transactions:

a. Purchased 134,700 pounds of raw material at a price of $9.10 per pound.

b. Used 122,080 pounds of the raw material to produce 32,100 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 26,680 hours at an average cost of $17.20 per hour.

d. Applied fixed overhead to the 32,100 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $378,400. Of this total, $297,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $81,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 32,100 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When applying fixed manufacturing overhead to production in transaction (d) above,the Work in Process inventory account will increase (decrease) by:

Definitions:

Price Ceilings

Government-imposed limits on the maximum prices that can be charged for certain goods and services, intended to protect consumers.

Ration Coupons

Certificates or vouchers that allow the holder to purchase a certain amount of scarce goods, often used during shortages to ensure fair distribution.

Legally Determined Market Prices

Prices set by law or regulation rather than by market forces of supply and demand.

Ticket Scalping

The practice of buying tickets to an event and reselling them at a higher price, often to profit from high demand and limited supply.

Q23: The variable overhead efficiency variance for January

Q37: The variable component of the predetermined overhead

Q61: Division E of Harveq Company has the

Q81: Mcdougald Corporation is a service company that

Q83: The following data pertains to Timmins Company's

Q138: Pickell Incorporated makes a single product--a cooling

Q164: Wangerin Corporation applies overhead to products based

Q218: The materials quantity variance for January is:<br>A)

Q249: At Rost Corporation,indirect labor is a variable

Q357: If the actual level of activity is