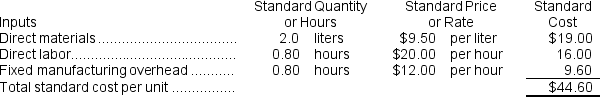

Alberts Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $240,000 and budgeted activity of 20,000 hours.

During the year, the company applied fixed overhead to the 15,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $223,700. Of this total, $147,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $76,000 related to depreciation of manufacturing equipment.

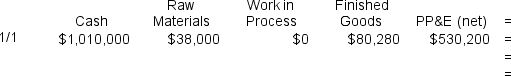

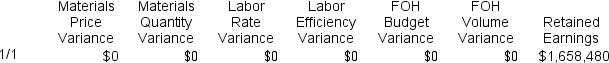

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

Definitions:

Collateral

Property or assets pledged by a borrower to secure a loan or other credit, and subject to seizure on default.

Security Interest

A legal claim or lien on collateral that has been pledged, usually to secure repayment of a debt.

Financing Statement

A document filed by a creditor to indicate a security interest in the assets of a debtor, typically used in secured transactions.

State Agency

An organization or body created by the government to carry out specific functions on a state level.

Q6: Whenever possible,service department costs should be separated

Q16: If outside customers demand only 50,000 units

Q25: The spending variance for cleaning equipment and

Q36: Signore Corporation uses a standard cost system

Q54: When the direct labor cost is recorded,which

Q79: Isenberg Corporation manufactures one product.It does not

Q115: The activity variance for cleaning equipment and

Q148: The materials quantity variance for March is:<br>A)

Q238: Fortes Inc.has provided the following data concerning

Q269: The activity variance for net operating income