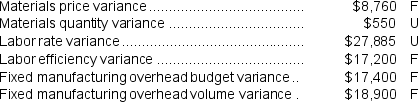

Woodhead Inc. manufactures one product. It does not maintain any beginning or ending inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. Its standard cost per unit produced is $37.45. During the year, the company produced and sold 24,400 units at a price of $47.40 per unit and its selling and administrative expenses totaled $92,000. The company does not have any variable manufacturing overhead costs. It recorded the following variances during the year:

-The net operating income for the year is closest to:

Definitions:

Gestalt Psychology

A psychological approach that emphasizes understanding the whole experience rather than breaking it down into parts.

Insight

The sudden realization or understanding of the solution to a problem, often perceived as an "aha" moment.

Scientific Method

An organized way of using experience and testing ideas to expand and refine knowledge.

Correlations

A measure of the relationship between two or more variables, indicating the degree to which they occur together or affect each other.

Q8: Merone Corporation applies manufacturing overhead to products

Q25: Levar Corporation has two operating divisions--a Consumer

Q71: Landoni Corporation uses a standard cost system

Q74: Bondi Corporation makes automotive engines.For the most

Q119: The variable overhead rate variance for March

Q152: The total amount of manufacturing overhead applied

Q199: The activity variance for net operating income

Q298: The occupancy expenses in the flexible budget

Q341: The medical supplies in the flexible budget

Q353: Wisseman Corporation is a shipping container refurbishment