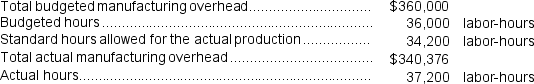

Carattini Incorporated makes a single product--an electrical motor used in many long-haul trucks.The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period.Data concerning the most recent year appear below: The total amount of manufacturing overhead applied is closest to:

The total amount of manufacturing overhead applied is closest to:

Definitions:

Unamortized Discount

The portion of a bond discount that has not yet been expensed to interest expense over the bond's life.

Carrying Value

The book value of an asset as reflected in a company's financial statements, calculated as the original cost minus accumulated depreciation.

Straight-Line Method

A method of calculating depreciation by evenly spreading the cost of an asset over its useful life.

Effective Interest Rate

The actual cost of borrowing or the actual return on investment, taking into account the effect of compounding interest as opposed to the nominal rate.

Q38: Eagan Corporation manufactures one product.The company uses

Q41: Kropf Inc.has provided the following data concerning

Q81: Dellarocco Incorporated makes a single product--a cooling

Q98: When recording the raw materials used in

Q149: Pattison Corporation is a service company that

Q163: Sherburne Snow Removal's cost formula for its

Q201: The revenue in the company's flexible budget

Q242: Fixed costs should not be ignored when

Q261: The administrative expenses in the planning budget

Q279: A spending variance is the difference between