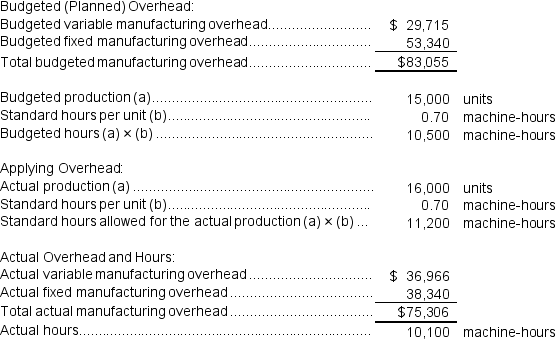

Emanuele Incorporated makes a single product--a critical part used in commercial airline seats.The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period.Data concerning the most recent year appear below:

Required:

Required:

a.Compute the variable component of the company's predetermined overhead rate.

b.Compute the fixed component of the company's predetermined overhead rate.

c.Compute the company's predetermined overhead rate.

d.Determine the variable overhead rate variance for the year.

e.Determine the variable overhead efficiency variance for the year.

f.Determine the fixed overhead budget variance for the year.

g.Determine the fixed overhead volume variance for the year.

h.Determine whether overhead was underapplied or overapplied for the year and by how much.

Definitions:

Competitors

Other businesses or individuals offering similar products or services in the same market, vying for the same customer base.

Convenient Locations

Places that are easily accessible to customers, often chosen by businesses to enhance visibility and accessibility, leading to increased customer traffic.

Customer Relationship Management

A strategy for managing an organization's interactions with current and potential customers, often using data analysis to study large amounts of information.

Private-label Merchandise

Products that are manufactured or provided by one company for offer under another company's brand, often found in retail to offer exclusive branding options to the retailer.

Q3: The labor efficiency variance for June is:<br>A)

Q13: What was Tantanka's variable overhead efficiency variance?<br>A)

Q67: A volume variance and budget variance are

Q97: A benefit from budgeting is that it

Q161: The personnel expenses in the planning budget

Q172: The direct labor budget begins with the

Q184: The labor efficiency variance for the month

Q203: The following are budgeted data:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2580/.jpg" alt="The

Q216: The total standard cost per unit is

Q313: The net operating income in the planning