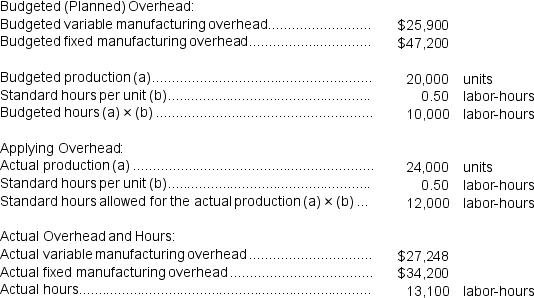

Fabert Incorporated makes a single product--a cooling coil used in commercial refrigerators.The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period.Data concerning the most recent year appear below:

Required:

Required:

a.Determine the variable overhead rate variance for the year.

b.Determine the variable overhead efficiency variance for the year.

c.Determine the fixed overhead budget variance for the year.

d.Determine the fixed overhead volume variance for the year.

Definitions:

Direct Tax

is a type of tax directly imposed on individuals or entities, such as income tax and property tax, which cannot be passed onto others.

Payroll Tax

Charges levied on both employers and employees, typically based on a proportion of the wages that businesses distribute to their workers.

Wage Base

The maximum amount of earnings that is subjected to certain taxes, such as Social Security taxes, within a given time period.

Excise Tax

A tax charged on specific goods and services, such as alcohol and tobacco, usually to discourage their use or generate revenue.

Q50: The fixed component of the predetermined overhead

Q113: The activity variance for wages and salaries

Q163: The fixed overhead budget variance is:<br>A) $57,675

Q181: The net operating income in the flexible

Q193: The raw materials quantity variance for the

Q200: The administrative expenses in the planning budget

Q205: The standards for product V28 call for

Q255: The spending variance for manufacturing overhead in

Q294: When using a flexible budget,a decrease in

Q313: The net operating income in the planning