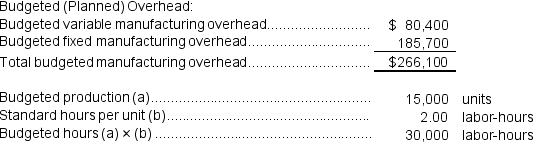

(Appendix 10A) Fredin Incorporated makes a single product--an electrical motor used in many long-haul trucks. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

-The predetermined overhead rate is closest to:

Definitions:

Dividends Received Deduction

A tax deduction that a corporation can claim for dividends received from other corporations within the same tax group.

Taxable Income

The portion of an individual's or entity's income used to determine how much tax is owed to the government in a given tax year.

Domestic Corporation

A corporation that is registered, operates, and is taxed in its home country, adhering to the legal and regulatory standards of that country.

Fiscal Year-End

The completion of a one-year, or twelve-month, accounting period, after which financial statements are produced.

Q8: Woodhouse Corporation manufactures one product.It does not

Q44: The variable overhead rate variance for the

Q48: An unfavorable volume variance means that the

Q109: When applying fixed manufacturing overhead to production

Q124: Dori Castings is a job order shop

Q134: What is the variable overhead efficiency variance

Q177: The spending variance for plane operating costs

Q237: The administrative expenses in the planning budget

Q246: The direct labor standards for a particular

Q253: The spending variance for wages and salaries