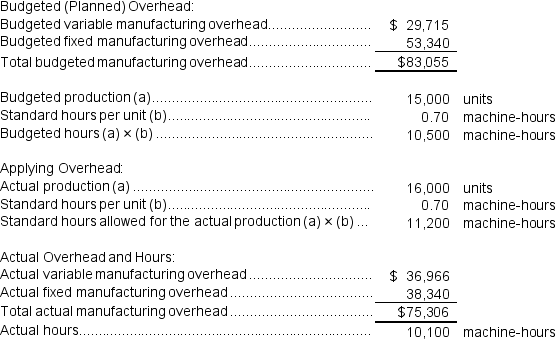

Emanuele Incorporated makes a single product--a critical part used in commercial airline seats.The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period.Data concerning the most recent year appear below:

Required:

Required:

a.Compute the variable component of the company's predetermined overhead rate.

b.Compute the fixed component of the company's predetermined overhead rate.

c.Compute the company's predetermined overhead rate.

d.Determine the variable overhead rate variance for the year.

e.Determine the variable overhead efficiency variance for the year.

f.Determine the fixed overhead budget variance for the year.

g.Determine the fixed overhead volume variance for the year.

h.Determine whether overhead was underapplied or overapplied for the year and by how much.

Definitions:

Epistatic Effects

Interactions between different genes where the effect of one gene is modified by one or several other genes, which can mask or alter the expression of the first gene.

Linkage Disequilibrium

A non-random association of alleles at different genes that are located close to one another on the same chromosome.

Genotypic Interaction

Refers to the complex ways in which genes within an organism interact with each other to influence the organism's traits.

Genetically Programmed Responses

Innate behaviors or reactions in organisms that are predetermined by their genetic makeup and manifest without prior learning or experience.

Q15: The total expenses in the flexible budget

Q51: What was Tantanka's fixed manufacturing overhead volume

Q54: When the direct labor cost is recorded,which

Q86: The following standards for variable manufacturing overhead

Q105: The production budget is typically prepared prior

Q132: The total manufacturing overhead is underapplied or

Q140: The variable overhead rate variance is:<br>A) $6,052

Q163: The fixed overhead budget variance is:<br>A) $57,675

Q237: The administrative expenses in the planning budget

Q398: The amount shown for revenue in the