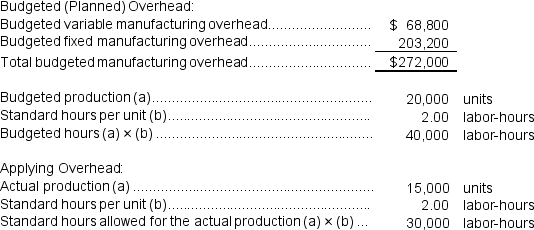

Gaters Incorporated makes a single product--an electrical motor used in many long-haul trucks.The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period.Data concerning the most recent year appear below:

The company incurred a total of $240,080 in manufacturing overhead cost during the year.

The company incurred a total of $240,080 in manufacturing overhead cost during the year.

Required:

Determine whether overhead was underapplied or overapplied for the year and by how much.

Definitions:

Date Of Record

The specific date set by a company on which the shareholders must be on record to be eligible to receive dividends or other distributions.

Cash Dividend

A payment made by a company out of its profits to shareholders, usually in the form of cash.

Date Of Payment

Date of the dividend payment.

Q6: The manufacturing overhead in the flexible budget

Q10: When recording the direct labor costs,the Cash

Q16: Rodarta Corporation applies manufacturing overhead to products

Q49: The activity variance for direct labor in

Q105: Cardero Midwifery's cost formula for its wages

Q113: The raw materials quantity variance for the

Q116: The labor rate variance for January is:<br>A)

Q138: Pabon Corporation makes one product.Budgeted unit sales

Q220: At Jacobson Company,indirect labor is a variable

Q250: The facility expenses in the flexible budget