Neubert Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During December, the company budgeted for 5,300 units, but its actual level of activity was 5,340 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for December:

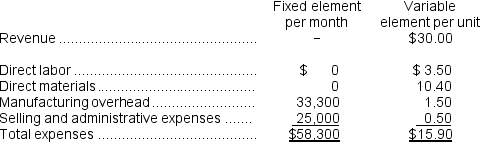

Data used in budgeting:

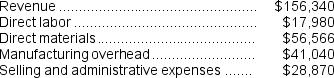

Actual results for December:

Actual results for December:

-The manufacturing overhead in the flexible budget for December would be closest to:

Definitions:

Inventories

Assets held for sale in the ordinary course of business, in the process of production for such sale, or in the form of materials or supplies to be consumed in the production process or in the rendering of services.

Year 1

Refers to the first year in a given time series, fiscal period, or timeframe under consideration.

Absorption Costing

An accounting approach that includes all manufacturing costs (direct materials, direct labor, and both variable and fixed overhead) in the cost of a product.

Operating Income

The profit realized from a company's everyday business operations, calculated by subtracting operating expenses from gross profit.

Q48: The activity variance for plane operating costs

Q55: Which of the following statements is NOT

Q72: When recording the direct labor costs,the Work

Q89: The activity variance for total expenses for

Q92: The direct materials in the flexible budget

Q155: The expected cash collections for May is

Q191: The cash disbursements during June for goods

Q223: In the merchandise purchases budget,the required purchases

Q369: The spending variance for total expenses for

Q407: Cosden Corporation is an oil well service