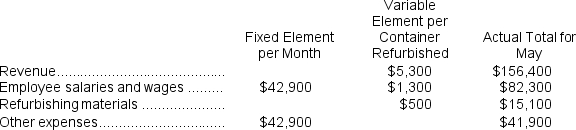

Stegemann Corporation is a shipping container refurbishment company that measures its output by the number of containers refurbished. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for May.

When the company prepared its planning budget at the beginning of May, it assumed that 27 containers would have been refurbished. However, 29 containers were actually refurbished during May.

When the company prepared its planning budget at the beginning of May, it assumed that 27 containers would have been refurbished. However, 29 containers were actually refurbished during May.

-The revenue in the company's flexible budget for May would have been closest to:

Definitions:

Unocal Test

A legal standard used to determine if the defensive measures taken by a board of directors during a takeover bid are in the best interests of the corporation and its shareholders.

Conflicted Interest

A situation where a person's personal interests could interfere with their professional duties or responsibilities, potentially leading to bias.

Takeover's Threat

Takeover's threat refers to the risk of an unsolicited attempt by one company to gain control of another by acquiring its shares.

Go Private

The process by which a publicly traded company is transformed into a privately held entity, often through the purchase of all outstanding shares.

Q15: Heyl Corporation is conducting a time-driven activity-based

Q79: The estimated unit product cost is closest

Q79: Isenberg Corporation manufactures one product.It does not

Q132: If the budgeted cash disbursements for manufacturing

Q134: Whitmer Corporation is working on its direct

Q170: The revenue variance for May would be

Q173: Marst Corporation's budgeted production in units and

Q190: If the budgeted cost of raw materials

Q249: At Rost Corporation,indirect labor is a variable

Q412: The "Employee salaries and wages" in the