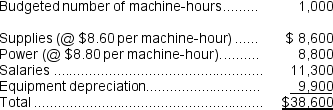

Moncrief Corporation bases its budgets on machine-hours. The company's static planning budget for July appears below:

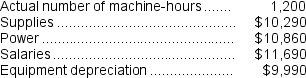

Actual results for the month were:

Actual results for the month were:

-The spending variance for power costs in the flexible budget performance report for the month should be:

Definitions:

Capital Budgeting

The process of planning and evaluating investments in long-term assets to determine which projects will generate the most profitable returns.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts, making the expense predictable and consistent.

Income Taxes

Taxes levied by governments on individuals' or businesses' net income, where the amount owed varies based on the level of the income earned.

Operating Cash Inflow

Cash generated from a company's primary business operations, excluding non-operational sources like investments or financing.

Q53: The spending variance for occupancy expenses in

Q64: Speyer Medical Clinic measures its activity in

Q135: If the actual level of activity is

Q154: Craney Corporation makes one product and it

Q156: Haylock Inc.bases its manufacturing overhead budget on

Q185: If the budgeted direct labor time for

Q187: The total number of units to be

Q198: The budgeted required production for May is

Q217: Sincell Corporation uses customers served as its

Q345: The net operating income in the planning