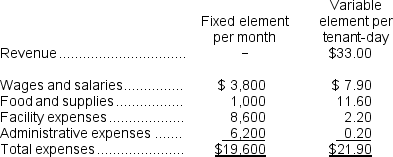

Grohs Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During December, the kennel budgeted for 2,500 tenant-days, but its actual level of activity was 2,530 tenant-days. The kennel has provided the following data concerning the formulas to be used in its budgeting:

-The net operating income in the planning budget for December would be closest to:

Definitions:

Harmonized Sales Tax

A combined tax that merges a country's federal tax system with that of its states or provinces, used in some countries including Canada.

HST

Harmonized Sales Tax, a combined tax that includes both federal and provincial sales taxes in some Canadian provinces.

Financial Liability

An obligation to pay money to another party, including loans, bond issuances, and accounts payable.

Notes Payable

A formal, written agreement to pay a certain amount of money, with interest, by a specified future date.

Q33: When recording the raw materials used in

Q67: The amount shown for revenue in the

Q83: The budgeted fixed manufacturing overhead cost was:<br>A)

Q119: Bentsen Corporation makes one product. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2580/.jpg"

Q125: Retained earnings at the end of December

Q204: If the budgeted cost of raw materials

Q214: The budgeted accounts receivable balance at the

Q262: The activity variance for manufacturing overhead in

Q290: The plane operating costs in the planning

Q312: Which of the following may appear on