Piechocki Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During May, the company budgeted for 5,900 units, but its actual level of activity was 5,940 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for May:

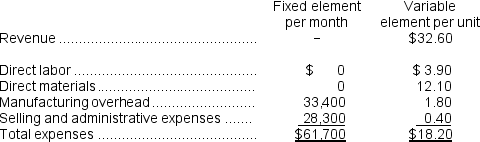

Data used in budgeting:

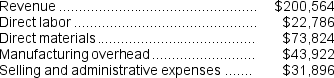

Actual results for May:

Actual results for May:

-The spending variance for direct materials in May would be closest to:

Definitions:

Machine-Hours

A measure of the amount of time a machine is utilized during the production process, often used in cost accounting to allocate expenses.

Job-Order Costing

A costing method used to accumulate costs associated with a specific batch of products or job, allowing for detailed tracking of production expenses.

Overapplied Overhead

A situation where the allocated manufacturing overhead cost is more than the actual overhead incurred.

Manufacturing Overhead

Refers to all the indirect factory-related costs incurred from manufacturing a product that cannot be directly traced to a specific product.

Q21: On the Customer Cost Analysis report in

Q25: The amount of cash collected during June

Q66: One disadvantage of budgeting is that budgeting

Q80: The total fixed cost at the activity

Q98: The October cash disbursements for manufacturing overhead

Q120: Thilking Midwifery's cost formula for its wages

Q163: Cash collections in a schedule of cash

Q201: The revenue in the company's flexible budget

Q257: Brookings Corporation is an oil well service

Q290: The plane operating costs in the planning