Dinham Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During March, the kennel budgeted for 2,000 tenant-days, but its actual level of activity was 2,040 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for March:

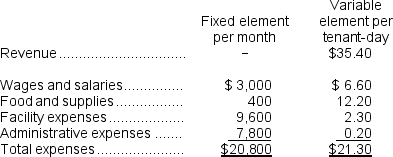

Data used in budgeting:

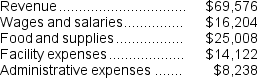

Actual results for March:

Actual results for March:

-The spending variance for facility expenses in March would be closest to:

Definitions:

Domestic Output

The comprehensive total of all goods and services' value created inside a country's limits during a certain timeframe.

Average Tax Rate

The fraction of total income that is paid as taxes, calculated by dividing the total amount of taxes paid by the taxpayer's total income.

Marginal Tax Rate

The tax rate that applies to the next dollar of taxable income, indicating the percentage of any additional earnings that will be paid in taxes.

Progressive Tax

A tax system in which the tax rate increases as the taxable amount goes up, making higher earners pay a larger percentage of their income than lower earners.

Q3: The estimated direct labor cost for February

Q49: Gallucci Incorporated makes a single product--a critical

Q57: Ekholm Corporation is a shipping container refurbishment

Q98: The October cash disbursements for manufacturing overhead

Q126: The salary paid to a store manager

Q144: Knappert Corporation makes one product and has

Q151: The spending variance for facility expenses in

Q177: The spending variance for plane operating costs

Q178: The revenue variance for September would be

Q235: Kerekes Manufacturing Corporation has prepared the following