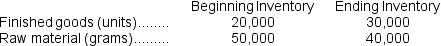

Sarafiny Corporation is in the process of preparing its annual budget. The following beginning and ending inventory levels are planned for the year.

Each unit of finished goods requires 7 grams of raw material. The company plans to sell 270,000 units during the year

Each unit of finished goods requires 7 grams of raw material. The company plans to sell 270,000 units during the year

-The number of units the company would have to manufacture during the year would be:

Definitions:

Net Incomes

The total earnings of a company after deducting all expenses, taxes, and costs from its total revenues.

Deferred Income Tax

Deferred Income Tax is a liability on a company's balance sheet that results from income already earned and recognized for accounting purposes but not yet subject to taxation.

Fair Value

The estimated market price of an asset or liability, reflecting what a willing buyer would pay to a willing seller in an arm's length transaction.

Q8: The "Travel expenses" in the flexible budget

Q17: On the Customer Cost Analysis report in

Q76: Rohn Corporation is conducting a time-driven activity-based

Q80: The estimated direct labor cost for November

Q98: The October cash disbursements for manufacturing overhead

Q167: Bitonti Corporation has provided the following data

Q186: Tracie Corporation manufactures and sells women's skirts.Each

Q203: The following are budgeted data:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2580/.jpg" alt="The

Q253: WV Construction has two divisions: Remodeling and

Q284: The activity variance for wages and salaries