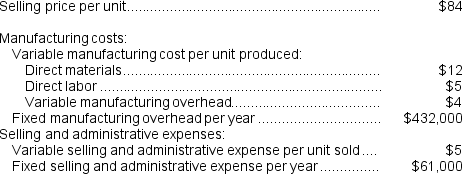

Neef Corporation has provided the following data for its two most recent years of operation:

-The net operating income (loss) under absorption costing in Year 2 is closest to:

Definitions:

Equipment Cost

Equipment cost refers to the purchase price and associated expenses of acquiring equipment for business operations, including delivery and installation fees.

Depreciation Tax Shield

The reduction in taxable income that results from the allowance for depreciation expenses, lowering tax liability.

CCA Rate

Capital Cost Allowance rate, used for tax purposes to determine the yearly depreciation of tangible property.

Maintenance

The process of preserving or keeping equipment, systems, or facilities in effective operating condition through routine checks and repairs.

Q34: Romeiro Corporation is preparing its cash budget

Q65: Masde Corporation produces and sells Product CharlieD.To

Q106: How many units would the company have

Q129: Kaaua Corporation has provided the following data

Q167: Data concerning Kardas Corporation's single product appear

Q180: Sales in Store J totaled:<br>A) $400,000<br>B) $250,000<br>C)

Q193: The estimated direct labor cost for February

Q197: What is the net operating income for

Q252: The unit product cost under absorption costing

Q274: Fowler Corporation manufactures a single product.Operating data