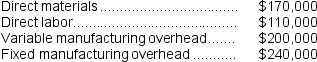

Krepps Corporation produces a single product. Last year, Krepps manufactured 20,000 units and sold 15,000 units. Production costs for the year were as follows:

Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.

Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-Under absorption costing,the ending inventory for the year would be valued at:

Definitions:

Budgeted Sales Data

Projections or estimates of sales for a future period, used for planning and forecasting purposes.

Cash Collections

The process of gathering all cash receipts and payments, including from sales, loans, and other transactions, over a specific period.

Manufacturing Overhead Budget

A financial plan that estimates the indirect costs associated with manufacturing, including utilities, maintenance, and rent.

Direct Materials

Raw materials that are directly incorporated into a finished product and can be easily traced to it.

Q6: If 39,720 pounds of raw materials are

Q19: The company has budgeted to produce 28,000

Q43: Under super-variable costing,which of the following is

Q52: If 54,480 pounds of raw materials are

Q53: J Corporation has two divisions.Division A has

Q77: In a process costing system,overhead is allocated

Q88: The units in beginning work in process

Q96: On the Customer Cost Analysis report in

Q181: Expected cash collections in December are:<br>A) $68,000<br>B)

Q219: Sufra Corporation is planning to sell 100,000