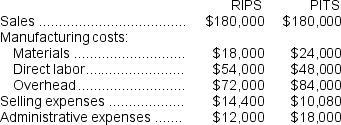

Omstadt Corporation produces and sells only two products that are referred to as RIPS and PITS.Production is "for order" only,and no finished goods inventories are maintained; work in process inventories are negligible.The following data relate to last month's operations:

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

Prepare a segmented income statement,in total and for the two products.Use the contribution approach.

Definitions:

Q16: Super-variable costing is most appropriate where:<br>A) direct

Q31: The net operating income for the year

Q33: The break-even point in unit sales is

Q54: How many dolls were started in the

Q83: Assume the company's target profit is $12,000.The

Q111: Under absorption costing,the unit product cost is:<br>A)

Q155: The margin of safety percentage is closest

Q243: This question is to be considered independently

Q272: Mckissic Corporation has two divisions: Domestic and

Q284: Muckleroy Corporation has two divisions: Division K