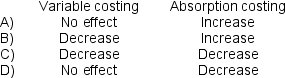

In its first year of operations,Bronfren Corporation produced 800,000 sets and sold 780,000 sets of artificial tan lines.What would have happened to net operating income in this first year under the following costing methods if Bronfren had produced 20,000 fewer sets? (Assume that Bronfren has both variable and fixed production costs.)

Definitions:

Ajax's Profits

The earnings acquired by Ajax, a fictional or specific enterprise, after deducting all costs associated with its operations.

Nash Equilibrium

A concept in game theory where no player can benefit by changing their strategy while the other players' strategies remain unchanged, indicating a stable state of gameplay.

Profits-Payoff Table

A financial tool used to display potential profits or losses of various outcomes based on a set of assumptions or strategies.

Duopoly

A market structure dominated by two firms, each having significant control over the market price and influencing competition dynamics.

Q14: To attain its desired ending cash balance

Q27: The variance for net operating income in

Q33: The break-even point in unit sales is

Q34: Romeiro Corporation is preparing its cash budget

Q41: Seventy percent of Pitkin Corporation's sales are

Q46: The expected cash collections for February is

Q100: The master budget consists of a number

Q189: Variable costing net operating income is usually

Q242: Variable manufacturing overhead costs are treated as

Q281: Under the absorption costing method,a company can