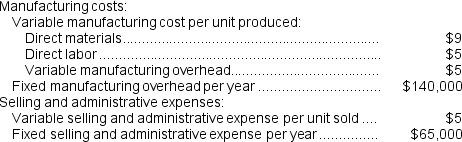

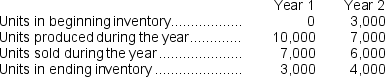

Smidt Corporation has provided the following data for its two most recent years of operation:

-The net operating income (loss) under absorption costing in Year 2 is closest to:

Definitions:

Lumpy Assets

Those assets that cannot be acquired smoothly, and that require large, discrete additions. For example, an electric utility that is operating at full capacity cannot add a small amount of generating capacity, at least not economically.

Financial Forecasting

The process of estimating or predicting how a business will perform in the future through the use of historical data and other information.

Fixed Assets Added

Refers to the purchase or acquisition of physical assets by a company that are expected to be used for longer than one accounting period.

Working Capital Strategy

A business approach focusing on managing a company's operational needs efficiently by balancing current assets and current liabilities to maintain liquidity.

Q7: On the Capacity Analysis report in time-driven

Q10: Electrical costs at one of Finfrock Corporation's

Q13: Assume that the company uses an absorption

Q64: On the Capacity Analysis report in time-driven

Q73: Using the high-low method,the estimate of the

Q83: The estimated unit product cost is closest

Q111: On the Customer Cost Analysis report in

Q114: The total cash collected during January by

Q136: Assume the company's target profit is $17,000.The

Q199: Generally speaking,net operating income under variable and