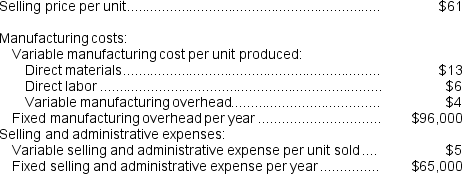

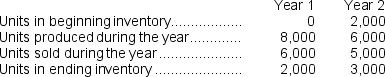

Sherwood Corporation has provided the following data for its two most recent years of operation:

Required:

Required:

a.Assume the company uses absorption costing.Compute the unit product cost in each year.

b.Assume the company uses variable costing.Compute the unit product cost in each year.

c.Assume the company uses absorption costing.Prepare an income statement for each year.

d.Assume the company uses variable costing.Prepare an income statement for each year.

e.Prepare a report in good form reconciling the variable costing and absorption costing net incomes.

Definitions:

Prepaid Asset

Expenses paid in advance and recorded as assets before they are used or consumed.

Pre-Tax Book Income

The income of a company before taxes as reported in its financial statements, according to accounting principles.

Taxable Income

Income on which tax must be paid. Total income minus exemptions and deductions is used to calculate this figure.

Income Tax Expense

The amount of expense recognized in a given period for taxes on profits, reflecting the expected cash outflow to tax entities.

Q14: Bakan Corporation has provided the following production

Q48: Using the high-low method,the estimate of the

Q59: This question is to be considered independently

Q61: Decaprio Inc.produces and sells a single product.The

Q87: What is the unit product cost for

Q95: Liz,Inc.,produces and sells a single product.The product

Q163: Schlenz Inc.,which produces a single product,has provided

Q186: The unit product cost under absorption costing

Q194: Which of the following statements is true

Q228: A shift in the sales mix from