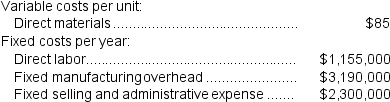

(Appendix 6A) Leheny Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 55,000 units and sold 50,000 units. The company's only product is sold for $238 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 55,000 units and sold 50,000 units. The company's only product is sold for $238 per unit.

-Assume that the company uses an absorption costing system that assigns $21 of direct labor cost and $58 of fixed manufacturing overhead to each unit that is produced.The net operating income under this costing system is:

Definitions:

Coupon Rate

The interest rate stated on a bond or other fixed-income security, represented as a percentage of the principal amount.

Restrictive Covenants

Clauses in a contract that limit certain actions of the parties involved, often used in employment agreements and loan documents to protect business interests.

Call Provision

A feature in certain debt instruments that allows the issuer to repay the debt before its maturity date, usually at a specified call price.

Sinking Fund

A fund established by an organization to set aside revenue over a period for the future repayment of debt.

Q4: Brester Corporation is conducting a time-driven activity-based

Q86: The desired ending inventory of Material K

Q90: Capes Corporation is a wholesaler of industrial

Q114: What is the unit product cost for

Q129: When all materials are added at the

Q176: The production department of Tarre Corporation has

Q220: The impact on net operating income of

Q235: Under variable costing,the value of the ending

Q240: Rachal Corporation produces and sells a single

Q267: Delisa Corporation has two divisions: Division L