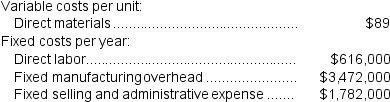

(Appendix 6A) Letcher Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 56,000 units and sold 54,000 units. The company's only product is sold for $227 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 56,000 units and sold 54,000 units. The company's only product is sold for $227 per unit.

-The company is considering using either super-variable costing or an absorption costing system that assigns $11 of direct labor cost and $62 of fixed manufacturing overhead to each unit that is produced.Which of the following statements is true regarding the net operating income in the first year?

Definitions:

Cost-Plus Approach

A pricing tactic that involves setting a sales price by adding a predetermined margin to the cost of the product.

Administrative Expenses

Costs related to the general management and administration of a company, such as salaries of executive officers and costs of general services.

Normal Levels

Standard measurements or averages that are considered typical or expected within a specific context, such as production, performance, or inventory levels.

Cost-Plus Approach

A pricing strategy where a fixed percentage or amount is added to the cost of producing a product or service to determine its selling price.

Q21: A soft drink bottler incurred the following

Q42: At the budgeted sales level of 10,000

Q93: What is the company's overall net operating

Q117: Jarvis Corporation is conducting a time-driven activity-based

Q123: The cost per equivalent unit for conversion

Q123: This question is to be considered independently

Q137: Sipho Corporation manufactures a single product.Last year,the

Q168: Succulent Juice Corporation manufactures and sells premium

Q192: Mechem Corporation produces and sells a single

Q260: Singapore Candy Cane Corporation is a single