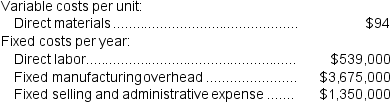

(Appendix 6A) Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

-Assume that the company uses a variable costing system that assigns $11 of direct labor cost to each unit that is produced.The unit product cost under this costing system is:

Definitions:

S&P 500 Index

An American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

S&P 500 Future

A futures contract that bets on the future value of the S&P 500 index, a major American stock market index.

Mispricing

Mispricing refers to a situation where the market price of a security does not reflect its true value, which can be due to various factors like information asymmetry or market inefficiencies.

Limited Liability Partnerships

A form of business partnership where some or all partners have limited liability, protecting them from some or all of the partnership's debts and liabilities.

Q13: The company's net operating income for the

Q16: A quick look at a scattergraph of

Q23: Grandin Corporation manufactures and sells one product.The

Q31: The net operating income for the year

Q34: Romeiro Corporation is preparing its cash budget

Q39: The net operating income (loss)under absorption costing

Q42: On the Capacity Analysis report in time-driven

Q99: Combe Corporation has two divisions: Alpha and

Q197: What is the net operating income for

Q281: Under the absorption costing method,a company can