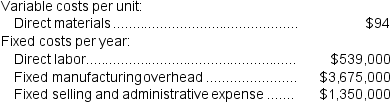

(Appendix 6A) Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

-Assume that the company uses an absorption costing system that assigns $11 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced.The net operating income under this costing system is:

Definitions:

Legal Issues

Matters or disputes that involve laws, legal principles, or proceedings.

Remedies Sought

The legal means or actions pursued by a plaintiff or complainant in a lawsuit seeking relief or justice for grievances.

West's Federal Appendix

A reporter of federal court decisions that are not selected for publication in the Federal Reporter.

Binding Precedent

A previous court decision that must be followed by lower courts within the same jurisdiction in cases involving similar facts or legal issues.

Q59: Absorption costing treats all manufacturing costs as

Q60: The R<sup>2</sup> (i.e.,R-squared)tells us the percentage of

Q72: The margin of safety percentage is closest

Q84: If the company sells 3,600 units,its total

Q103: On the Capacity Analysis report in time-driven

Q105: Beamish Inc.,which produces a single product,has provided

Q150: Kelchner Corporation has provided the following contribution

Q196: The Consumer Division's break-even sales is closest

Q226: The net operating income (loss)under variable costing

Q241: The net operating income (loss)under absorption costing