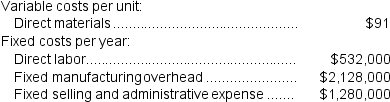

(Appendix 6A) Stubenrauch Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 38,000 units and sold 32,000 units. The company's only product is sold for $240 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 38,000 units and sold 32,000 units. The company's only product is sold for $240 per unit.

-Assume that the company uses a variable costing system that assigns $14 of direct labor cost to each unit that is produced.The net operating income under this costing system is:

Definitions:

Motion to Dismiss

A legal procedure requesting the court to dismiss a case for reasons such as lack of jurisdiction, failure to state a claim, or other grounds.

Motion for Judgment

A formal request to a court for a decision to be made based on the facts presented, typically without going to trial.

Motion to Dismiss

A legal procedure by which a defendant requests the court to dismiss a case on specific grounds, such as lack of legal foundation or evidence.

Affirmative Defenses

Legal defenses used in litigation where the defendant introduces evidence, apart from denying the allegations, to avoid liability.

Q26: Caneer Corporation produces and sells a single

Q34: Walker Enterprises,Inc.,uses a job-order costing system and

Q39: Edal Corporation has provided the following production

Q48: A decrease in the number of units

Q57: Frisch Corporation produces and sells a single

Q148: The budgeted cash receipts for December are:<br>A)

Q184: The company's degree of operating leverage is

Q190: The margin of safety is the amount

Q198: The smaller the contribution margin ratio,the smaller

Q203: Under variable costing,only variable production costs are