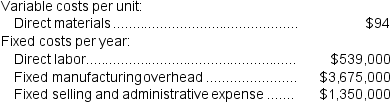

(Appendix 6A) Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

-The unit product cost under super-variable costing is:

Definitions:

Real Defenses

Legal defenses that can be used to invalidate a negotiable instrument, such as forgery, fraud, duress, or incapacity.

Specified

Clearly stated or identified in a particular context or document.

Restrictive Indorsements

Endorsements placed on a negotiable instrument, like a check, that limit how the instrument can be used or further transferred.

Indorsements for Deposit

Signatures or statements on the back of a negotiable instrument, such as a check, indicating that it can be deposited into a specific account.

Q4: How much cost,in total,was assigned to the

Q10: The cost per equivalent unit for materials

Q32: Assume the company's target profit is $14,000.The

Q35: Assume that the company uses a variable

Q62: If the company sells 9,100 units,its total

Q83: Poirrier Corporation uses process costing.The following data

Q115: On the Capacity Analysis report in time-driven

Q133: Assuming that direct labor is a variable

Q186: The unit product cost under absorption costing

Q282: The net operating income (loss)under variable costing