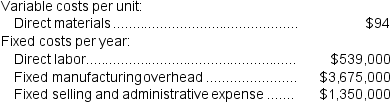

(Appendix 6A) Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

-Assume that the company uses a variable costing system that assigns $11 of direct labor cost to each unit that is produced.The net operating income under this costing system is:

Definitions:

Financial Statement

A formal record of the financial activities and position of a business, individual, or other entity.

Accrual Accounting

An accounting method that records revenues and expenses when they are incurred, regardless of when cash transactions occur, providing a more accurate picture of a company's financial condition.

Recorded

The act of documenting financial transactions in the accounting records or ledgers of a company.

Adjusted Trial Balance

A financial statement that lists all accounts of a company and their balances after adjustments have been made.

Q15: The cost per equivalent unit for conversion

Q32: What was the absorption costing net operating

Q36: The best estimate of the total cost

Q41: Genereux Corporation is conducting a time-driven activity-based

Q84: Garrell Corporation is conducting a time-driven activity-based

Q136: The Northern Division's break-even sales is closest

Q137: Anders Inc.uses the weighted-average method in its

Q195: The contribution margin ratio is closest to:<br>A)

Q197: Sattler Corporation has provided the following contribution

Q235: Under variable costing,the value of the ending