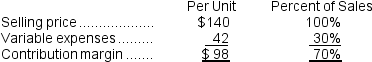

Houpe Corporation produces and sells a single product. Data concerning that product appear below:

Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month. Consider each of the following questions independently.

Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month. Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Houpe Corporation.Refer to the original data when answering this question. The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $11 per unit.In exchange,the sales staff would accept a decrease in their salaries of $58,000 per month.(This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units.What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Volcanic Explosion

A volcanic explosion occurs when magma, gases, and rocks are violently expelled from a volcano, often with significant force and the potential for widespread impact.

Meteoroid Impact

The collision of a meteoroid (a small rocky or metallic body in outer space) with another celestial body, such as an asteroid, planet, or moon, causing a crater or larger-scale impacts.

Meteoroid Impact

Meteoroid impact refers to the collision of a meteoroid with another celestial body, such as Earth, resulting in the creation of impact craters and sometimes initiating geological changes.

Upheaval Dome

A geological structure caused by the upward movement of underground salt creating a dome-shaped feature on the Earth’s surface.

Q1: If sales increase to 3,040 units,the increase

Q4: Evan's Electronics Boutique sells a digital camera.The

Q45: The accounting department of Archer Company,a merchandising

Q46: (The R<sup>2</sup> (i.e.,R-squared)varies from 0% to 100%,and

Q53: J Corporation has two divisions.Division A has

Q56: Swofford Inc.has provided the following data concerning

Q59: Dainels Corporation uses the step-down method to

Q92: Onyemah Corporation uses the FIFO method in

Q113: Hedman Corporation has provided the following contribution

Q141: Mcquage Corporation has provided its contribution format