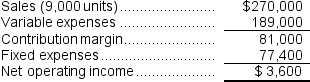

Stonebraker Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.

Required:

Required:

a.If sales increase to 9,040 units,what would be the estimated increase in net operating income?

b.If the variable cost per unit increases by $6,spending on advertising increases by $3,000,and unit sales increase by 19,200 units,what would be the estimated net operating income?

j.Estimate how many units must be sold to achieve a target profit of $26,100.

Definitions:

Debt Ratio

A financial ratio that measures the extent of a company's leverage, calculated by dividing its total liabilities by its total assets.

Land and Building

Real estate assets, including both the ground itself and any structures on it, considered key components of property investment and valuation.

Machinery

Equipment with moving mechanical parts used in industrial or manufacturing processes to facilitate production.

Cash in Hand

Refers to the amount of currency and negotiable instruments that are immediately available for business transactions or expenses, not deposited in a bank or invested.

Q1: The management of Hamano Corporation would like

Q2: What are the equivalent units for conversion

Q31: Sunnripe Corporation manufactures and sells two types

Q34: Grawburg Inc.maintains a call center to take

Q43: Tatar Corporation is a manufacturer that uses

Q46: The cost per equivalent unit for conversion

Q59: This question is to be considered independently

Q97: What are the equivalent units for conversion

Q106: Bachelet Inc.uses the weighted-average method in its

Q255: What is the net operating income for