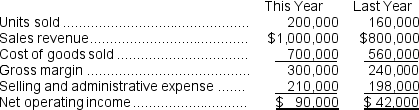

Butler Sales Company is a distributor that has an exclusive franchise to sell a particular product made by another company.Butler Sales Company's traditional format income statements for the last two years are given below:

Selling and administrative expense is a mixture of fixed costs and variable costs that vary with respect to the number of units sold.

Selling and administrative expense is a mixture of fixed costs and variable costs that vary with respect to the number of units sold.

Required:

a.Estimate the company's variable selling and administration expense per unit,and its total fixed selling and administrative expense per year.

b.Compute the company's contribution margin for this year.

Definitions:

Hand-Knit Sweaters

Apparel created by interlocking yarn with knitting needles, entirely crafted by hand.

Enforceable Oral Contract

A verbal agreement that is legally binding and can be enforced in a court of law, under certain conditions.

Assets

Resources with economic value owned by an individual, company, or country, expected to provide future benefits.

Standard Construction Rule

In legal interpretation, this rule dictates that ambiguous contract terms should be construed against the drafter.

Q19: The cost per equivalent unit for materials

Q27: Vallin Manufacturing Corporation's beginning work in process

Q42: Billings Corporation uses the FIFO method in

Q45: The accounting department of Archer Company,a merchandising

Q75: Malcolm Company uses a weighted-average process costing

Q164: In July,Meers Corporation sold 3,700 units of

Q172: If sales increase to 6,020 units,the increase

Q198: The total contribution margin for the month

Q235: Under variable costing,the value of the ending

Q255: In the Schedule of Cost of Goods