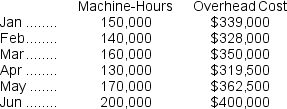

(Appendix 5A) The management of Casablanca Manufacturing Corporation believes that machine-hours is an appropriate measure of activity for overhead cost. Shown below are machine-hours and total overhead costs for the past six months:

Assume that the relevant range includes all of the activity levels mentioned in this problem.

Assume that the relevant range includes all of the activity levels mentioned in this problem.

-If Casablanca expects to incur 185,000 machine hours next month,what will the estimated total overhead cost be using the high-low method?

Definitions:

Net Present Value (NPV)

NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time, used in capital budgeting to assess the profitability of an investment or project.

Unbiased Cash Flows

Cash flows projection that is objective and has not been influenced by personal bias, making them fair estimates for analysis.

Overstate Cash Inflows

The act of exaggerating or reporting higher amounts of money coming into a business than what is actually being received, which can lead to a misleading financial position.

Terminal Values

In finance, the calculated value of a business or project beyond the forecast period when future cash flows can be estimated.

Q8: Marston Corporation uses the FIFO method in

Q13: Assume that the company uses an absorption

Q61: If 7,800 setups are projected for the

Q69: The cost of ending work in process

Q107: Bosshart Inc.has provided the following data for

Q133: In process costing,a separate work in process

Q151: Brancati Inc.produces and sells two products.Data concerning

Q165: If the Northern Division's sales last year

Q214: In a CVP graph (sometimes called a

Q227: The net operating income (loss)under absorption costing