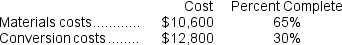

Gunes Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 800 units. The costs and percentage completion of these units in beginning inventory were:

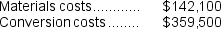

A total of 8,500 units were started and 7,400 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

A total of 8,500 units were started and 7,400 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending inventory was 50% complete with respect to materials and 35% complete with respect to conversion costs.

The ending inventory was 50% complete with respect to materials and 35% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-The total cost transferred from the first processing department to the next processing department during the month is closest to:

Definitions:

Acid-Test Ratio

A financial metric used to gauge a company's liquidity by comparing its most liquid assets, without including inventory, to its current liabilities.

Profitability

This refers to the ability of a business to generate earnings as compared to its expenses over a specified period.

Liquidity

The ease with which assets can be converted into cash without significantly affecting their value.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations with its current assets over current liabilities.

Q52: Ellithorpe Corporation has provided the following data

Q69: The cost of ending work in process

Q74: Tusa Corporation is a manufacturer that uses

Q91: In October,one of the processing departments at

Q92: Worrel Corporation manufactures a single product.The following

Q113: Hedman Corporation has provided the following contribution

Q175: The Cost of Goods Manufactured was:<br>A) $19,900<br>B)

Q179: Piekos Corporation incurred $90,000 of actual Manufacturing

Q201: Fisher Corporation uses a predetermined overhead rate

Q223: Mossfeet Shoe Corporation is a single product