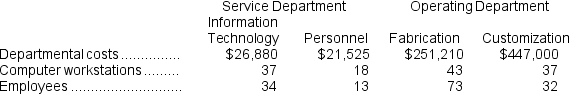

(Appendix 4B) Ockey Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Information Technology and Personnel, and two operating departments, Fabrication and Customization.

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

-The total Fabrication Department cost after service department allocations is closest to:

Definitions:

Marginal Cost

The cost incurred by producing one additional unit of a product or service, crucial for decision-making in production levels.

Optimal Amount

The ideal quantity of a resource or good that achieves the best outcome or utility.

Positive Externalities

Benefits that result from a commercial activity or action but affect uninvolved third parties who did not choose to be involved in the transaction.

Spillover Benefits

Positive effects or advantages that result from a product, event, or activity, affecting those who are not directly involved.

Q15: Using the weighted-average method,the equivalent units for

Q17: Eban Corporation uses the FIFO method in

Q48: The total Geriatric Medicine Department cost after

Q48: Using the high-low method,the estimate of the

Q78: The cost of goods manufactured for July

Q80: Forbes Corporation uses a predetermined overhead rate

Q96: Montesdeoca Corporation has provided the following contribution

Q116: Which of the following statements is not

Q135: Job cost sheets contain entries for actual

Q146: Sagon Corporation has provided data concerning the