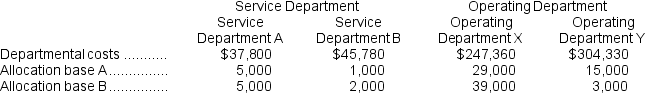

(Appendix 4B) Strzelecki Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Service Department A and Service Department B, and two operating departments, Operating Department X and Operating Department Y. Data concerning those departments follow:

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.

-In the first step of the allocation,the amount of Service Department A cost allocated to the Operating Department X is closest to:

Definitions:

Machine-Hours

An indicator of manufacturing productivity that calculates the total hours machinery is active in the production cycle.

Manufacturing Overhead

Refers to all the costs associated with the manufacturing process except for direct materials and direct labor.

Variable Manufacturing Overhead

Variable manufacturing overhead includes expenses that fluctuate with production levels, such as materials and utility costs directly associated with manufacturing.

Fixed Manufacturing Overhead

Costs that do not vary with the level of production or sales, such as rent, salaries, and insurance for manufacturing facilities.

Q12: Rondo Children's Clinic allocates service department costs

Q29: In the first step of the allocation,the

Q37: A number of companies in different industries

Q57: Koehl Corporation uses the direct method to

Q85: In the department's cost reconciliation report for

Q90: How many units were started into production

Q111: The company's unit contribution margin is closest

Q154: Gullett Corporation had $26,000 of raw materials

Q160: Data concerning Follick Corporation's single product appear

Q204: How much is the cost of goods