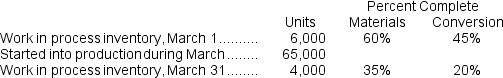

(Appendix 4A) Activity in Saggers Corporation's Assembly Department for the month of March follows:

-The equivalent units for conversion for March,using the FIFO method,are:

Definitions:

Progressive Income Tax

A tax system where the tax rate increases as the taxable amount increases, placing a higher tax burden on high-income earners.

Ability-to-Pay Principle

A tax principle suggesting that taxes should be levied according to an individual or entity's capacity to pay, generally implying that those with higher incomes should pay more tax.

Proportional Income Tax

A tax system where the tax rate remains constant regardless of the amount of income, thus taxing all income levels at the same percentage.

Horizontal Equity

The principle that individuals or entities in similar financial situations should be treated equally by the tax system or other public policies.

Q37: A number of companies in different industries

Q52: In May,one of the processing departments at

Q100: The total cost transferred from the first

Q117: Grib Corporation uses a predetermined overhead rate

Q121: The schedule of cost of goods manufactured

Q124: The balance in the Finished Goods inventory

Q145: Which of the following would usually be

Q146: The amount of overhead applied to Job

Q238: The unit product cost for Job K332

Q239: The amount of overhead applied to Job