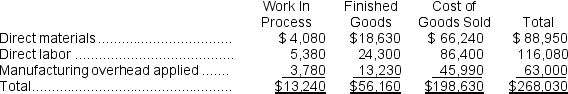

Seuell Inc.has provided the following data for the month of December.There were no beginning inventories; consequently,the direct materials,direct labor,and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was overapplied by $12,000.

Manufacturing overhead for the month was overapplied by $12,000.

The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process,finished goods,and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.

The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for December would include the following:

Definitions:

Accrued Selling Expenses

Expenses that have been incurred but not yet paid in the selling process, recorded on the balance sheet.

Accrued Income Taxes

Taxes that have been incurred, but not yet paid, usually recognized at the end of an accounting period.

Operating Activity

Activities that are part of the day-to-day operations of a business, such as selling, general, and administrative expenses.

Treasury Stock

Shares that were issued and later reacquired by the issuing company.

Q2: What are the equivalent units for conversion

Q4: Wessendorf Corporation uses a job-order costing system

Q8: Kreuzer Corporation is using a predetermined overhead

Q17: Stoltz Corporation uses the direct method to

Q21: If the company bases its predetermined overhead

Q80: Laflame Corporation uses a job-order costing system

Q84: The credits to the Work in Process

Q104: When materials are purchased in a process

Q116: Refer to the T-account below:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2580/.jpg" alt="Refer

Q190: If the actual manufacturing overhead cost for