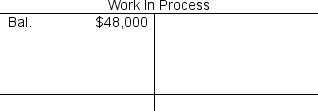

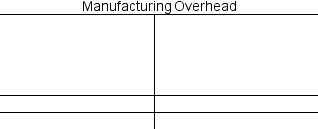

Dagostino Corporation uses a job-order costing system. The following data relate to the just completed month's operations.

(1) Direct materials requisitioned for use in production, $154,000

(2) Indirect materials requisitioned for use in production, $45,000

(3) Direct labor wages incurred, $94,000

(4) Indirect labor wages incurred, $119,000

(5) Depreciation recorded on factory equipment, $44,000

(6) Additional manufacturing overhead costs incurred, $83,000

(7) Manufacturing overhead costs applied to jobs, $236,000

(8) Cost of jobs completed and transferred from Work in Process to Finished Goods, $458,000

Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts below.

-The total amount of manufacturing overhead actually incurred was:

Definitions:

Lunch Entrée

A main dish served during the lunch meal, often featuring a protein with accompaniments such as vegetables or grains.

Sustainable Competitive Advantage

A unique advantage over competitors that can be maintained over time, ensuring long-term success of the business.

Product Excellence

The achievement of superior quality, performance, and innovation in a product, distinguishing it from competitors and meeting or exceeding customer expectations.

Distinctive Brand Image

A unique visual, emotional, or conceptual identity associated with a brand that sets it apart from competitors.

Q4: Reddicks Clinic uses the step-down method to

Q18: Assuming that Owens Corporation uses the weighted-average

Q44: Lenning Corporation uses the FIFO method in

Q68: The amount of overhead applied to Job

Q69: The cost of goods manufactured for the

Q105: Solt Corporation uses a job-order costing system

Q111: Whether a company uses process costing or

Q148: Assume that the company uses a plantwide

Q158: Assume that the company uses departmental predetermined

Q168: During March,Zea Inc.transferred $50,000 from Work in