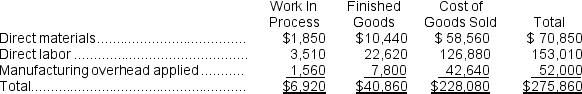

Reith Inc. has provided the following data for the month of November. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.

Manufacturing overhead for the month was overapplied by $4,000.

Manufacturing overhead for the month was overapplied by $4,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The cost of goods sold for November after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Definitions:

Labor Cost

Refers to the total expense incurred by employers for the compensation of their workforce, including wages, benefits, and taxes.

Materials Cost

The total expense to an entity for all materials used in the production of a product or service.

Break-even Chart

A graphical representation used in financial analysis to show the point at which total costs and total revenue are exactly equal; thus, there is no loss or gain.

Break-even Point

The financial state where total costs and total revenues are equal, meaning there is no net loss or gain, and one has "broken even."

Q2: In the cost reconciliation report under the

Q4: Reddicks Clinic uses the step-down method to

Q13: Torri Manufacturing Corporation has a traditional costing

Q24: During September at Renfro Corporation,$65,000 of raw

Q28: Under the FIFO method,the cost per equivalent

Q36: Suppose the company uses the direct method

Q52: The total Corporate Law Department cost after

Q65: The debits to the Work in Process

Q116: Which of the following statements is not

Q239: When manufacturing overhead is applied to production,it