The Collins Corporation uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of materials used in production.At the beginning of the most recent year,the following estimates were made as a basis for computing the predetermined overhead rate for the year:

manufacturing overhead cost,$200,000; direct materials cost,$160,000.The following transactions took place during the year (all purchases and services were acquired on account):

a.Raw materials were purchased,$86,000.

b.Raw materials were requisitioned for use in production (all direct materials),$98,000.

c.Utility costs were incurred in the factory,$15,000.

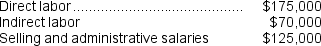

d.Salaries and wages were incurred as follows:

e.Maintenance costs incurred in the factory,$15,000.

e.Maintenance costs incurred in the factory,$15,000.

f.Advertising costs incurred,$89,000.

g.Depreciation recorded for the year,$80,000 (80% relates to factory assets and the remainder relates to selling,general,and administrative assets).

h.Rental cost incurred on buildings,$70,000,(75% of the space is occupied by the factory,and 25% is occupied by sales and administration).

i.Miscellaneous selling,general,and administrative costs incurred,$11,000.

j.Manufacturing overhead cost was applied to jobs as per company policy.

k.Cost of goods manufactured for the year,$500,000.

l.Sales for the year totaled $1,000,000.These goods cost $600,000 to produce.

Required:

Prepare journal entries for each of the above transactions.Assume that all transactions with external suppliers,employees,and customers were conducted in cash.

Definitions:

Cost

Refers to the amount of money incurred to produce or purchase goods or services.

Defective Motor

A motor that fails to operate within its specified performance criteria due to faults in design, material, or workmanship.

Discount Period

The time frame during which a payment made early is eligible for a discount according to the terms of the sales agreement.

Money Market Account

A type of savings account that typically offers both higher interest rates and greater withdrawal flexibility compared to regular savings accounts.

Q15: Bayest Manufacturing Corporation uses a predetermined overhead

Q22: Montuori Corporation uses a job-order costing system

Q40: What are the Fermenting Department's equivalent units

Q89: At the beginning of December,Altro Corporation had

Q126: Assume that the company uses departmental predetermined

Q143: The amount of overhead applied in the

Q201: Fisher Corporation uses a predetermined overhead rate

Q213: The credits to the Manufacturing Overhead account

Q230: In October,Raddatz Inc.incurred $73,000 of direct labor

Q265: The cost of lubricants used to grease