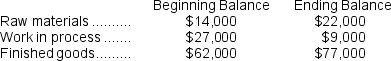

Baab Corporation is a manufacturing firm that uses job-order costing.The company's inventory balances were as follows at the beginning and end of the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost.The following transactions were recorded for the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost.The following transactions were recorded for the year:

• Raw materials were purchased,$315,000.

• Raw materials were requisitioned for use in production,$307,000 ($281,000 direct and $26,000 indirect).

• The following employee costs were incurred:

direct labor,$377,000; indirect labor,$96,000; and administrative salaries,$172,000.

• Selling costs,$147,000.

• Factory utility costs,$10,000.

• Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling,general,and administrative activities.

• Manufacturing overhead was applied to jobs.The actual level of activity for the year was 34,000 machine-hours.

• Sales for the year totaled $1,253,000.

Required:

a.Prepare a schedule of cost of goods manufactured.

b.Was the overhead underapplied or overapplied? By how much?

c.Prepare an income statement for the year.The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Definitions:

Surety

A person who promises to perform the same obligation as another person (the principal) and who is jointly liable along with the principal for that obligation’s performance.

Exoneration

The act of being relieved from a responsibility, obligation, or hardship; often used in legal contexts to denote clearing from guilt or blame.

Artisans Liens

Legal claims granted to artisans or mechanics who have rendered services or provided materials, securing their right to payment.

Statute

A written law passed by a legislative body at the national or local level.

Q1: The unit product cost of product N40S

Q48: Crowson Corporation uses a job-order costing system

Q56: In February,one of the processing departments at

Q122: A factory supervisor's salary would be classified

Q166: Direct costs:<br>A) are incurred to benefit a

Q166: Sonneborn Corporation has two manufacturing departments--Molding and

Q189: Lightner Corporation bases its predetermined overhead rate

Q210: Contribution format income statements are prepared primarily

Q237: The amount of overhead applied in the

Q276: Which of the following costs could contain